Blog Layout

Half Empty or Half Full? April 2019 Newsletter

Ross Silver • May 1, 2019

The age old litmus test of asking someone if a glass filled half-way with water is half empty or half full, is a heuristic for determining someone’s predisposition to being an optimist (half full) or the pessimist (half empty). I’ve always found it interesting that this binary outcome leaves little room for the realists among us, who, when presented with the same riddle would ask, “has the water level in the glass been rising or falling over time?” To a realist, that question is the key to understanding the overall direction a given system.

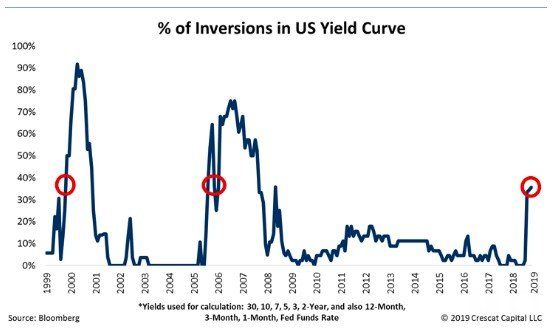

If that same realist were to appraise the market today in terms of being a glass half empty or half full, how might they see things? On the one hand, the U.S./China dispute continues create drag, economic growth is slowing in the U.S. and around the world, debt levels of U.S. corporations are extremely high, and much of the U.S. stimulus enacted over the past three years has largely been absorbed into the economy; additionally, the yield curve recently inverted which is historically a reliable recession indicator. Sum it all up and experts like PIMCO peg the odds of a U.S. recession at about 33%.

Pretty ominous, right?

On the other hand, while the economy has slowed, it’s still humming along with companies posting solid earnings and projecting moderate growth ahead. The U.S./China dispute could get resolved this year, and the Fed has paused raising rates, ended quantitative tightening, and there’s speculation that their next move could be downward (which could spur another round of growth). And while PIMCO does believe the odds of a recession are 1/3, it’s lower than it was in the fourth quarter of 2018.

So maybe things are headed in the right direction and we’re in for a soft landing.

Who’s right?

Rely on Principals

I’ve just finished reading Principals by legendary fund manager Ray Dalio, and it is without question one of the most extraordinary books I’ve ever read. Ray is a big believer in addressing current situations by applying principals learned from studying similar events that occurred in the past. It’s all about studying history…

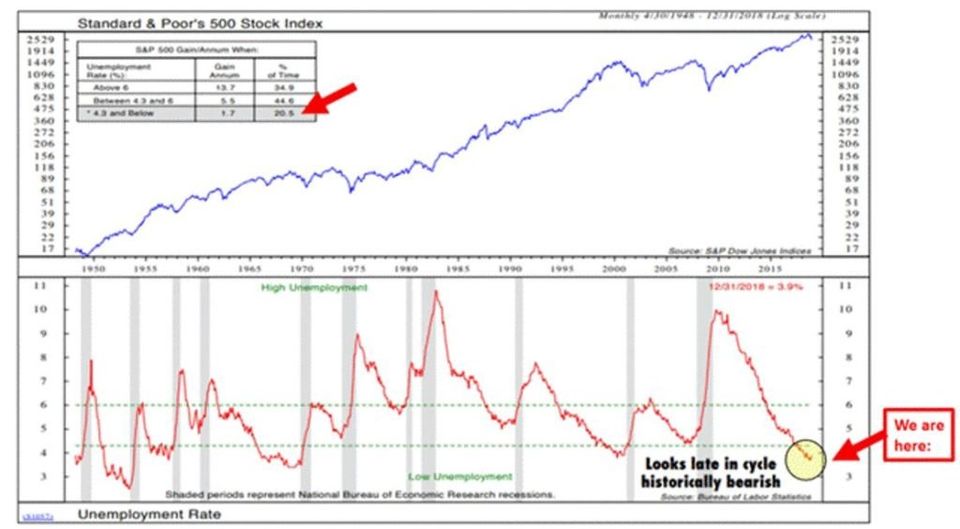

Though I’m a new devotee to the Ray Dalio school of thought, it doesn’t take a black belt in back-testing to look at some of our most recent recessionary periods (actually, the periods right before our most recent recessions) and compare them to today to see how things stack up.

A majority of the most devoted bulls will acknowledge we’re in the late stages of a bull run, which began in 2009. The question of course is, how late are we? I recently heard a very respectable fund manager say that we still have several years left to go.

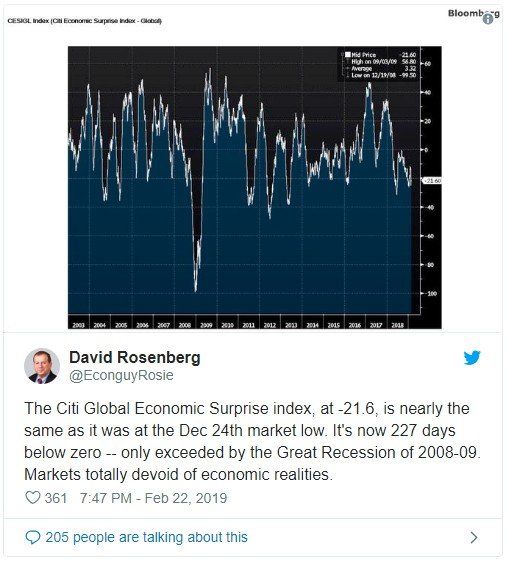

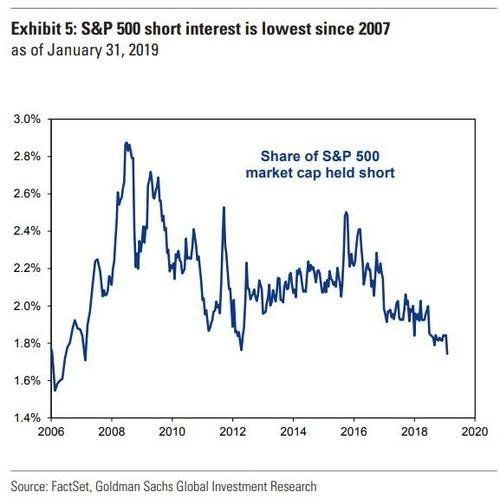

It’s certainly possible. The problem is, nobody really knows when a recession will start until we’re already in it. I distinctly remember something a fund manager said to me in mid-2007, “we know this is going to end badly, but we have to keep dancing until the music stops”. Is the music going to stop? Here are a couple of charts you may find interesting courtesy of Seeking Alpha.

The market doesn’t appear to be pricing in much risk, which is historically troublesome…

Regular readers of our newsletter know that we’re fans of yield curve analysis. And while the inversion of 2 and 10 year Treasuries has been an extremely accurate recession predictor over the last 40 years, the inversion itself (which occurred earlier this month) is actually a buy signal. That’s because a recession typically doesn’t follow until 12-24 months post the inversion.

If we’re to use history as our guide, it would appear the glass is draining rather than filling, but there’s still some water left so it’s not time to panic just yet. Here’s what to watch for: if sales slow and/or gross margins compress, a lot of companies (particularly those in the mid-market) will have difficulty servicing their large debt burdens. If that happens…look out.

Derby Dreaming

Alright racing fans, it is that time of year again, Derby time! This year there seems to be one standout horse: Omaha Beach, three horses with a big shot: Improbable, Game Winner and Tacitus and three horses who may be better than I think and may win: Roadster, Vekoma and Maximum Security. My gut tells me to fear Baffert and he has three in the race but my eyes tell me Omaha Beach is the real deal. I also will be using Win Win Win and Code of Honor in anything I do because they too have impressed me. So what do we do with so many choices? The expensive answer is box them all in a na exacta and pray that one of the big numbers is on top (finishes first) followed by another big number (in second). The brave answer, is take a stand on some of these and try not to hate yourself if a horse you liked sees its number light up next to "1st place." The Derby has been very chalky the past few years and I think that may change this year as the prep races have been full of upsets. I am going to take a stand against Omaha Beach only because I think Baffert is going to target that one with his three entrants and that could open up the race for a horse like Win Win Win who could come from a stalking position and blow by them all. Should that scenario transpire, Code of Honor has to be used as well. I am backing Win Win Win, who will likely be a massive price (20-1 or higher), along with Code of Honor who will also be a big price for my 1st place horses, underneath I will put the Baffert trio along with Omaha Beach, Tacitus and Vekoma. In addition, just in case Maximum Security is some freak of nature (he won the Florida Derby with ease), I will use Maximum Security on top with all the others horses I mentioned underneath. Maximum Security may just sneak away from this field while nobody pays attention to him.

Good luck!

Disclaimers & Disclosures: For a full list of disclaimers and disclosures, please visit:

https://www.sylvacap.com/disclaimer

Copyright © 2022 SylvaCap, All Rights Reserved. - Privacy Policy - Disclaimer